1m, a data and analytics technology company serving the risk management needs of large healthcare organizations, announced today that it has raised $10 million in Series A financing.

Read also – Crusoe Secures $600 Mn in Series D Round at $2.8 Bn Valuation to Power AI

The round consists of $7.3 million in venture funding and $2.7 million in converted securities. Funding has been led by Banner Health, with participation from Cleveland Clinic, Stanford Health Care, St. Charles Health System, Carle Foundation, and First Derivative Capital. Alongside the financing, representatives from Banner Health and Cleveland Clinic will be joining the 1m Board.

Read also – Twelve Labs Secures $30 Mn in Funding

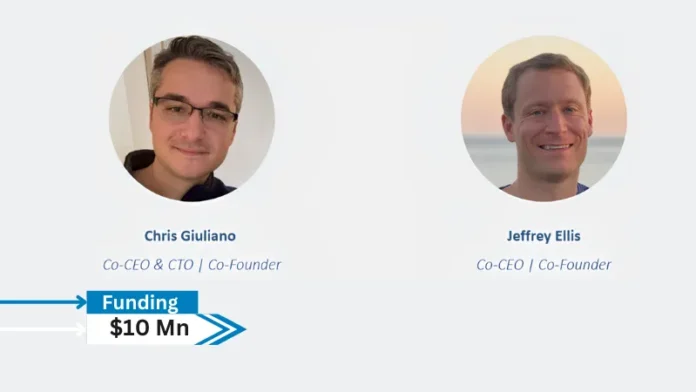

Led by former Goldman Sachs healthcare investment bankers Jeff Ellis and Chris Giuliano, 1m has developed a SaaS-based platform purpose-built to help healthcare systems manage financial, operational, and regulatory risk. The platform leverages robust data, analytics and monitoring tools that integrate seamlessly into existing risk management workflows to deliver timely, high-ROI decision support and anomaly detection.

The Series A funding will be used primarily to support the company’s go-to-market efforts, hire more technical talent, and expand its intellectual property.

“Financial sustainability is a critical challenge for healthcare systems dealing with razor-thin operating margins and rising costs. These organizations also face significant threats in the form of cyber risks, workforce shortages, extended revenue cycles, and growing regulatory requirements,” said Jeff Ellis, co-CEO of 1m. “We’re providing healthcare systems with a comprehensive and consistent view of risk across their organizations so that leaders can take effective action faster.”

Healthcare providers face challenges with risk management for a variety of reasons. Horizontal systems don’t reflect the specific complexities of the healthcare business model such as complex reimbursement models, high-stakes patient safety and quality requirements, and stringent data privacy and security needs. Risk management activities are also frequently siloed, using legacy technologies and people-dependent processes. As a result, it is difficult to obtain an accurate and comprehensive view of risk across the organization, leading to duplicate efforts, increased costs, and extended cycle times.

“Value-added risk management capabilities shouldn’t be a luxury reserved for large organizations,” said Chris Giuliano, co-CEO and CTO of 1m. “Affordability is key, and while automation helps, it’s not enough on its own. The solution lies in enabling risk management teams to co-own financial sustainability alongside the broader organization. That’s why we’re integrating data monitoring and anomaly detection into the risk management function—tools designed to drive margin improvement.”

1m has designed its platform in close collaboration with leading health systems. It offers a centralized source of truth that unifies enterprise risk, internal audit, and compliance teams into a cohesive risk management program. Specific capabilities include:

- End-to-end risk assessment workflow tools, reducing administrative burden

- Continuously updated, healthcare-specific risk datasets to flag emerging threats

- Quantification of operating and balance sheet risks and seamless integration with long-term financial and strategic planning

- Leadership-friendly dashboards with risk management program outputs to ensure engagement at the highest levels

- Built-in risk mitigation support, via proprietary data monitoring and anomaly detection tools

“Our partnership with 1m has allowed us to transform our risk management process, which is key to our strategy for sustainable growth,” said Scott Nordlund, Banner Health Chief Growth and Strategy Officer. “This cutting-edge solution unifies risk activities across the organization. We can foster executive and board engagement, embed risk insights into key decisions, navigate uncertainty and ensure that Banner maximizes its resources for what matters most—patient care.”

“The leadership team at Cleveland Clinic recognizes the value of data-driven insights in guiding our organizational and financial strategies,” said Dennis Laraway, Executive Vice President and Chief Financial Officer at Cleveland Clinic. “The ability to leverage risk-aware analytics provides a quantitative approach to risk management. Looking ahead, the development of a comprehensive healthcare industry risk dataset has the potential to transform our future state, empowering us with the intelligence needed to improve the economics of care.”

About 1m

1m is a data and analytics technology company serving large healthcare organizations through a B2B SaaS model. The company is setting the standard for risk management in healthcare, with an end-to-end risk management and data monitoring platform designed for Enterprise Risk, Internal Audit, Compliance, and Finance teams.