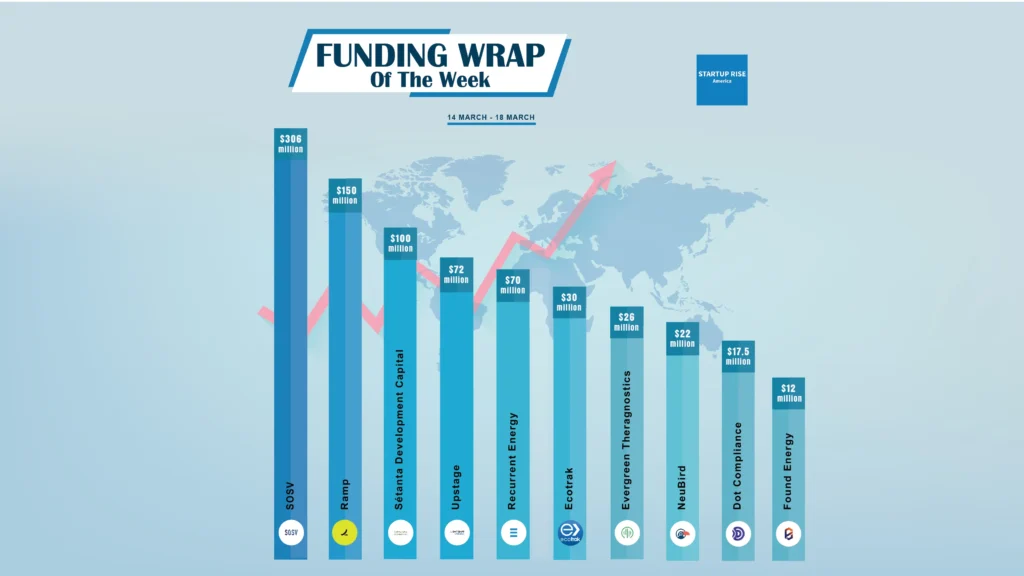

There are a lot of American startups funding deals that are creating buzz around the startup ecosystem. These are the growth-stage and early-stage deals of this week. Let’s talk about the Top 10 Funding deals.

The Top 10 American Startups Funding Deals

Table of Contents

SOSV

SOSV secures SOSV V fund, at $306million, the firm’s largest fund to date. It will focus on deep tech startups in human and planetary health, with an emphasis on the intertwined imperatives of decarbonization and re-industrialization—part of the fund’s mandate to “reinvent the means of production”—even as SOSV continues to pioneer investments in health ranging from therapeutics to medical devices.

Global venture funding company SOSV runs development programmes for early-stage startups. Programmes at SOSV are centred on cutting-edge deep technology that has promise for improving both the world and humankind.

Ramp

Ramp, a platform for financial automation, has raised its valuation to $7.65 billion after securing $150 million in series D-2 round fundraising. Khosla Ventures and Founders Fund jointly led this round, with new investors Sequoia Capital, Greylock, and 8VC joining in.

Ramp is an all-in-one solution that combines corporate cards with accounting automation, bill payment, vendor management, expenditure management, and more. Its goal is to save organisations money and time while enabling finance professionals to focus on their work to the fullest.

Sétanta Development Capital

Sétanta Development Capital, a supplier of financing for residential real estate secures $100million in credit facility from Victory Park Capital. The money will be used by the business to help with development financing for developers of residential land as well as acquisitions.

Setanta Development Capital offers non-recourse, high LTC loans for the development and purchase of residential real estate around the country. Their loan amounts range from $1 million to $80 million, and the typical time to close is less than 60 days.

Upstage

Upstage AI, a pioneering AI company specializing in large language models (LLMs) and Document AI, secures $72 million in Series B round funding. With this latest funding, Upstage has now raised over $100 million since its founding in October 2020, making it the most-funded AI software company in South Korean history.

Large-language models (LLMs) and document processing engines from industry leaders Upstage increase productivity. For strong and affordable AI solutions for businesses, our flagship large language model Solar sets the standard.

Recurrent Energy

Recurrent Energy, a worldwide developer and owner of solar and energy storage assets, raises $70 million in non-recourse project finance from Banco do Nordeste do Brasil S.A. (BNB) For its Jaiba III solar project in Brazil.

Recurrent Energy stands as one of the biggest and most geographically diverse platforms for utility-scale solar and energy storage project development, ownership, and operations in the world.

Ecotrak

Ecotrak, the leading intelligent facility management platform, secures $30million in funding, led by Respida Capital, with participation from Carver Road Capital, and existing investor Gala Capital Partners.

Ecotrak is changing the way work is done by pioneering the first Intelligent Facilities Management SaaS platform for multi-site businesses. Ecotrak’s Enterprise Asset Management Solution combines AI-enabled software with a network of highly trained service providers to digitally automate repair and maintenance workflows.

Evergreen Theragnostics

Evergreen Theragnostics, Inc., a clinical-stage radiopharmaceutical company, secures $26million in funding supported both by existing shareholders and new institutional investors, Petrichor and LIFTT.

Evergreen Theragnostics is focused on improving the available options for cancer patients using radiopharmaceuticals. The company is engaged in Contract Development and Manufacturing (CDMO) services as well as drug discovery and commercialization of proprietary products.

NeuBird

NeuBird, a cloud-based generative operations platform supplier for businesses secures $22million in seed funding Mayfield took the lead in the round. The money will be used by the company to hire AI ITOps engineers for the businesses. NeuBird, a company founded by Goutham Rao and Vinod Jayaraman, uses an AI workforce to implement generative AI.

At NeuBird, they are committed to utilising GenAI to create the real-time reactive IT operations of the future. They are applying the experience they have gained from working in the software business and developing enterprise-grade, large-scale solutions to Large Language Models in order to counteract the IT sector’s information explosion.

Dot Compliance

Dot Compliance, a supplier of AI-enabled quality management system (QMS) solutions secures $17.5million in series B round funding. Leading the round, which increased the total to $50 million, were IGP Capital and Vertex Ventures, with TPY Capital also participating.

The first fully functional eQMS for life sciences driven by AI is called Dot Compliance. Biotechnology, pharmaceutical, and medical device industries may get products to market more quickly and affordably using Dot Compliance’s eQMS, which is packed with generative AI capabilities.

Found Energy

Found Energy, a cleantech startup building industrial decarbonization solutions that harness the embodied energy of aluminum, secures $12million in seed funding. The round included investments from KOMPAS VC, Munich Re Ventures, Good Growth Capital, the Autodesk Foundation, J-Impact, GiTV, Massachusetts Clean Energy Center (MassCEC), and Glenfield Partners LTD.

Found Energy is building rechargeable aluminum fuel power systems aimed at eliminating carbon emissions from heavy industrial applications ranging from industrial heating (7% of global CO2 emissions) to maritime shipping (3% of global CO2 emissions).

These startups played a major role in American Startups Funding ecosystem in this week and secured funding from Venture Capitalists, Angle Investors in different funding Rounds.

Frequently asked questions (FAQs)

Name the Top American Startups Funding Deals in This Week?

SOSV, Ramp, Sétanta Development Capital, Upstage, Recurrent Energy, Ecotrak, Evergreen Theragnostics, NeuBird, Dot Compliance, Found Energy, are the Top 10 North American Startups Funding Deals of This Week.