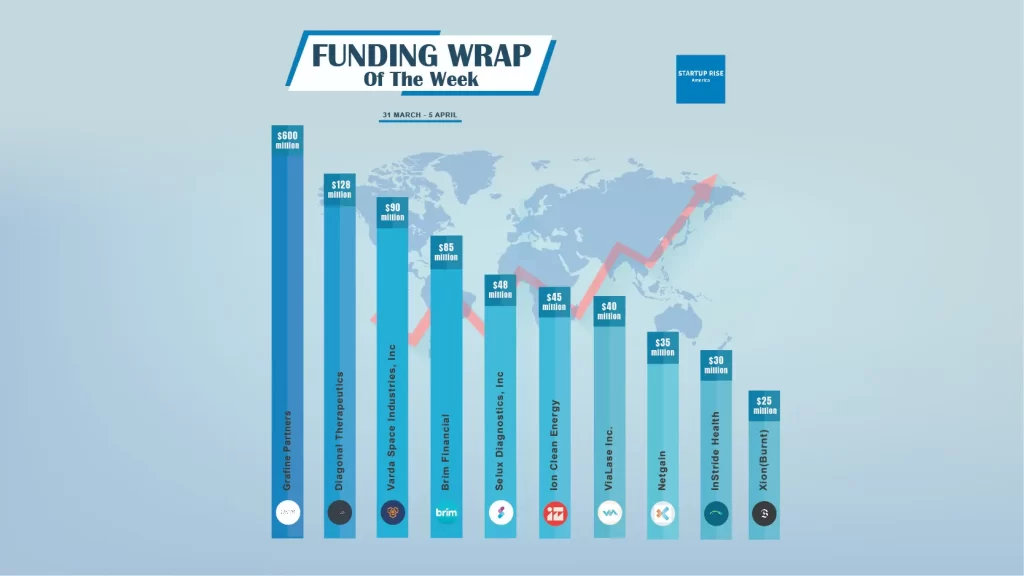

There are a lot of American startups funding deals that are creating buzz around the startup ecosystem. These are the growth-stage and early-stage deals of this week. Let’s talk about the Top 10 Funding deals.

The Top 10 American Startups Funding Deals

Table of Contents

Grafine Partners

Grafine Partners , a private investment firm secures $600Million for inaugural strategy funding. The Strategy exceeded its target of $500 million with commitments from a small and select group of institutional investors seeking new and innovative approaches to generating returns.

Grafine Partners, founded by Elizabeth Weymouth, is an alternative investment management firm created to meet the needs of sophisticated institutional investors seeking innovative approaches to invest private capital with a focus on alignment of incentives.

Diagonal Therapeutics

Diagonal Therapeutics, a biotechnology company pioneering a new approach to discovering and developing agonist antibodies, Secures $128Million in Funding. The Series A was co-led by BVF Partners and Atlas Venture, with participation from Lightspeed Venture Partners, RA Capital Management, Frazier Life Sciences, Viking Global Investors, Velosity Capital, and Checkpoint Capital.

Diagonal Therapeutics is a biotech company pioneering a new approach to discovering and developing agonist antibodies. The Company’s DIAGONAL platform combines proprietary computational and experimental techniques to overcome historical challenges associated with agonist antibody drug discovery.

Varda Space Industries, Inc

Varda Space Industries, Inc., in-space manufacturing and hypersonic Earth re-entry logistics company, secures $90million in series B round funding. Caffeinated Capital led the round, and Lux Capital, General Catalyst, Founders Fund, and Khosla Ventures also participated.

Varda is developing and constructing the necessary infrastructure, including as dependable and affordable reentry capsules and in-orbit industrial equipment, to enable various industries to reach low Earth orbit.

Brim Financial

Brim Financial (“Brim”), a leading fintech infrastructure company transforming the credit card platform and payment automation space, secures $85million in series C round funding on the back of strong revenue growth, rapidly increasing market share and expansion into the business and commercial segments.

Brim Financial is one the fastest growing enterprise technology companies, according to Deloitte’s Technology Fast 50™ in North America. Brim’s Credit-Card-as-a-Service has been recognized as best-in-class for product capabilities by Aite-Novarica Group in their analysis of global Credit-Card-as-a-Service providers.

Selux Diagnostics, Inc.

Selux Diagnostics, Inc., Preventing superbug infections and antimicrobial resistance (AMR) is the objective of this biotech company. Leading the round were RA Capital Management, with Schooner Capital, Sands Capital, and Northpond Ventures participating.

Selux Diagnostics is working on a Next Generation Phenotyping (NGP) platform that will significantly improve the speed and precision of prescribing targeted, individualised antibiotic medicines, potentially revolutionising the treatment of infectious disease patients.

Ion Clean Energy

ION Clean Energy (ION) it has raised $45 million fromChevron New Energies (CNE), a division of Chevron U.S.A. Inc., who is leading the round, and Carbon Direct Capital. ION is a Boulder-based technology company that provides post-combustion point-source capture technology through its third-generation ICE-31 liquid amine system.

Ion Clean Energy was founded in 2008 in Boulder, Colorado and is a worldwide leader in carbon dioxide capture technologies that reduce overall costs and make CO2 capture a more viable option for hard-to-abate emissions.

ViaLase Inc.

ViaLase, Inc. , A clinical-stage medical technology startup called has raised $40 million in a series C round of funding with the goal of filling gaps in the current paradigm for treating glaucoma. The financing was spearheaded by a new investor, with backing from existing investors such as Arboretum Ventures, Venture Investors Health Fund, and Falcon Vision, an ophthalmology investment platform backed by KKR.

The ViaLuxeTM Laser System is intended to lower intraocular pressure (IOP) by non-invasively creating customised drainage channels via the trabecular meshwork combining femtosecond laser accuracy and micron-accurate gonio imaging.

Netgain

Netgain, a provider of software for finance and accounting teams, secures $35million in funding. Leading the round was Summit Partners. Summit Partners’ managing director Greg Goldfarb has become a member of the board of directors. The company plans to grow the staff and improve product development with the money.

Netgain apps assist accountants in streamlining and automating procedures. They are a team of former Big Four accountants with extensive knowledge of NetSuite and lease accounting.

InStride Health

InStride Health, an outpatient provider of specialty pediatric anxiety and OCD treatment secures $30million in series B round funding. General Catalyst led investors and was joined by previous investors .406 Ventures, Valtruis, Mass General Brigham Ventures, and Hopelab Foundation.

InStride Health provides specialty outpatient care for pediatric Anxiety and Obsessive Compulsive Disorder (OCD) and related presentations. Co-founded by Harvard-trained clinicians from McLean Hospital, the InStride Health care model is grounded in evidence-based treatments: Cognitive Behavioral Therapy (CBT) and Acceptance and Commitment Therapy (ACT) with an emphasis on Exposure and Response Prevention (ERP).

Xion(Burnt)

Xion,(Burnt) a blockchain built with widespread adoption in mind. Arrington Capital, Draper Dragon, Sfermion, GoldenTree, Animoca Brands, Laser Digital (Nomura), Multicoin, and others were among the backers.

Burnt is a core contributor to XION, the first modular Generalized Abstraction layer purpose built for consumer adoption. Through protocol-level implementations related to abstracted accounts, signatures, fees, interoperability, and more, XION enables secure, intuitive, and seamless user experiences.

These startups played a major role in American Startups Funding ecosystem in this week and secured funding from Venture Capitalists, Angle Investors in different funding Rounds.

Frequently asked questions (FAQs)

Name the Top American Startups Funding Deals in This Week?

Grafine Partners, Diagonal Therapeutics, Varda Space Industries, Inc, Brim Financial, Selux Diagnostics, Inc., Ion Clean Energy, ViaLase Inc., Netgain, InStride Health, Xion(Burnt,) are the Top 10 North American Startups Funding Deals of This Week.