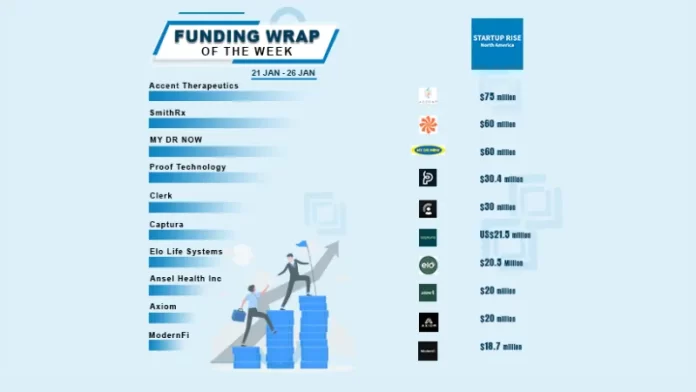

There are a lot of funding transactions in North America startup ecosystem for growth-stage and early-stage deals this week; we’ll discuss the top ten.

Here are the Top10 Funding Deals of this Week

Table of Contents

Accent Therapeutics

Accent Therapeutics secures $75M in series C round funding from Mirae Asset Capital Life Science, with participation from other new investors, Mirae Asset Capital, Mirae Asset Venture Investment, Bristol Myers Squibb and Johnson & Johnson Innovation – JJDC, Inc.

Accent Therapeutics is pioneering a new class of small molecule precision cancer therapies targeting critical intracellular dependencies that span multiple types of cancer. Building upon industry-leading expertise in RNA-modifying proteins (RMPs) and the systematic mapping of both the RMP space and adjacent high-value areas for drug discovery.

SmithRx

SmithRx secures $60M in series C round funding from Venrock. Their goal is to make pharmacy benefits less expensive and complicated for individuals and employers in the United States. Benefits from pharmacies are flawed. Big PBMs’ unduly intricate monopoly are only beneficial to their business lines.

For self-insured organisations, SmithRx is a transparent, pass-through pharmacy benefits manager. They run their business apart from pharmacies and insurance providers so that their incentives are entirely focused on their clients.

MY DR NOW

MY DR NOW secures $60million in funding from Dr Payam Zamani, Founder and CEO. They are transforming the delivery of healthcare, MY DR NOW. Their one and only goal is to give people and families all over the world easy access to top-notch medical care.

They are dedicated to ensuring that everyone has access to top-notch healthcare, regardless of their circumstances or background.

Proof Technology

Proof Technology secures $30.4million in series B round funding from Long Ridge Equity Partners, with participation from Blue Heron Capital and The LegalTech Fund, among other current investors.

Process service is being revolutionised by proof. Legal technology startup Proof immediately links legal practices around the country with independent process servers. Legal businesses can submit electronic serve requests around-the-clock, get real-time updates, view a map showing the verification of each attempt, and establish instantaneous connections with servers.

Clerk

Clerk secures $30million in series B round funding from CRV, with participation from Stripe, and existing investors Andreessen Horowitz and Madrona.

The goal of Clerk’s aim is to permanently resolve user management. Their crew is spread all throughout the globe and committed to giving developers the greatest possible experience, paying meticulous attention to every little detail.

Captura

Captura secures US$21.5million in series A round funding from Maersk Growth, Eni Next, Equinor Ventures, Future Planet Capital, Hitachi Ventures, Aramco Ventures, mTerra Ventures, and EIC Rose Rock Venture Fund .

The ocean is one of nature’s most potent forces and their best friend in the fight against climate change. Through an analysis of the planet’s natural cycles, Captura created a method known as “Direct Ocean Capture” that extracts CO2 from the ocean and uses it to restore the climate.

Elo Life Systems

Elo Life Systems secures $20.5million in series A2 round funding from DCVC Bio and Novo Holdings. They are joined by Hanwha Next Generation Opportunity Fund, AccelR8, and Alexandria Venture Investments. Elo has raised a total of $45 million to date.

Elo is reimagining the future of food – focusing on ingredients that empower consumers to feel good about the food they eat every day. From unique plant-based sweeteners to saving crops like the banana from extinction, Elo harnesses the untapped potential of nature to make food tastier, healthier and resilient while requiring less from the planet.

Ansel Health Inc.

Ansel Health Inc. secures $20M in funding from Portage, with participation from Two Sigma Ventures, Brewer Lane Ventures, SixThirty Ventures, Plug and Play Ventures, Digitalis Ventures, Symphony AI, Operator Partners, Morgan Creek Capital Management, and several others.

Founded in 2019, Ansel Health Inc. (“Ansel”) is an insurance technology company on a mission to build a world where health hardships don’t create financial hardships. Their new type of supplemental health insurance plan covers 13,000+ conditions and pays cash benefits upon diagnosis of a covered condition with no accident or hospitalization requirements.

Axiom

Axiom secures $20million in series A round funding from Standard Crypto and Paradigm led the round, and other participants included Robot Ventures, Ethereal Ventures, and a few builders from the ZK and crypto space. Haichen Shen from Scroll, Ye Zhang, Sandy Peng, and Hasu from Flashbots Liam Horne from Optimism / ETH Global, Collin Myers from Obol, Lakshman Sankar from Personae, Brendan Farmer and Daniel Lubarov from Polygon, Brendan Tong and Jasraj Bedi from Zellic, Zac Williamson and Joe Andrews from Aztec, and many more. Alex Atallah from OpenSea, Sreeram Kannan and Calvin Myers from EigenLabs, and many more.

Axiom allows for computation throughout Ethereum’s history, which is validated using on-chain ZK proofs. Integrate information from accounts, contracts, block headers, transactions, and receipts.

ModernFi

ModernFi secures $18.7M in series A round funding Canapi Ventures, Andreessen Horowitz, Remarkable Ventures, and leading banks Huntington National Bank, First Horizon, and Regions.

Financial institutions of all sizes may grow, hold onto, and manage their deposits with the help of ModernFi. Banks and credit unions can originate deposits, sweep money, and give depositors more protection using ModernFi’s deposit network.