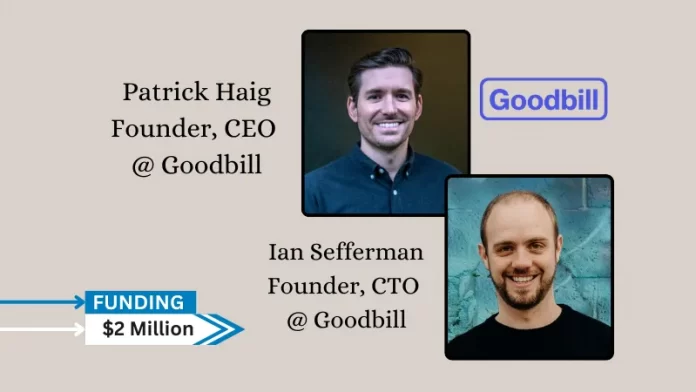

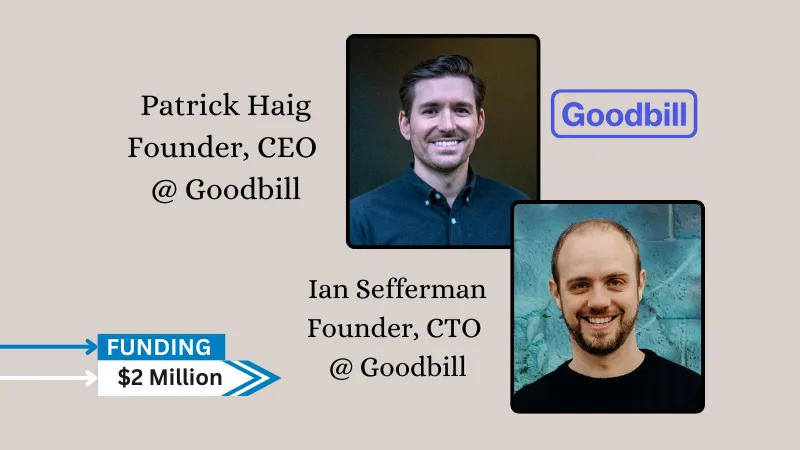

Goodbill, a startup that verifies that hospital bill is correct secures $2million in funding. Founders’ Co-op, Maveron, and Liquid 2 Ventures led the round, with participation from angel investors and other funds.

The company plans to further invest in its healthcare cost containment offering for self- and level-funded groups, as well as to broaden its operations and business reach.

Co-founded by Ian Sefferman and Patrick Haig, Goodbill offers a solution for plans that makes use of data, technology, artificial intelligence, and individualised member support to assist self-funded businesses in verifying the veracity of incoming hospital claims and securing savings and reductions prior to the plan paying the provider.

Read also – Blue Yonder deaclares an Agreement To Acquire One Network Enterprises

Goodbill checks a hospital’s claim for errors or inflated charges against the member’s medical record before sending it to the payer or employer. The system can immediately draw in data for these claim reviews because it is digitally integrated with the patient portals at over 2,500 hospitals nationwide. Because of this, Goodbill is able to evaluate each and every claim and offer prompt results prior to the plan paying the provider, rather than later.

Additionally, the platform determines if a member qualifies for a hospital claim 501(r) discount. At any of the more than 3,500 hospitals around the nation, Goodbill can quickly determine whether a member is qualified at any facility.

Read also – NYC-based Coro Raises $100Million in Series D Round Funding

About Goodbill

At Goodbill, their goal is to make healthcare billing clear, reliable, and reasonably priced for all. By examining each hospital claim for 501(r) discount opportunities, coding errors, and medically unnecessary care before payment is given to the provider, their cost containment technology helps patients, insurers, and payers save money.