College tuition keeps outpacing inflation, yet Americans hold only $525 billion in 529 accounts—still far short of upcoming bills, according to a January 2026 Bankrate analysis. A 529 lets your money grow federal-tax-free, most states add a deduction, and 2026 rules widen the upside: up to $35,000 of unused funds can later roll into a Roth IRA, and more vocational programs now qualify.

We reviewed every direct-sold plan, scoring fees, state-tax breaks, five-year returns, investment choice, and ease of use. The ten plans that follow stretch each dollar the furthest—helping you fund college while the window is wide open.

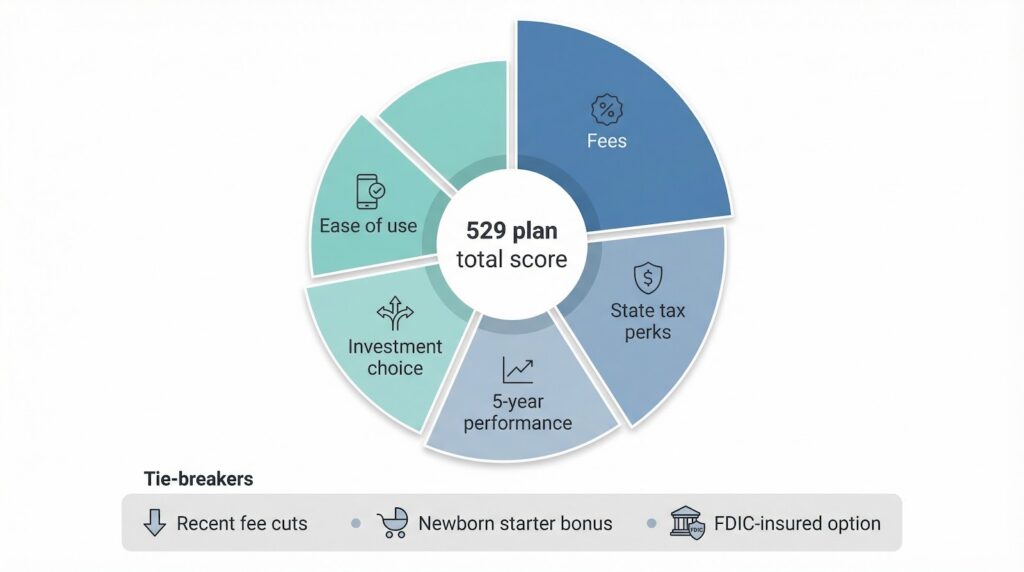

How we built the scoreboard

Great rankings start with a clear score sheet. We reviewed more than 50 direct-sold 529 plans and ran each one through a five-factor model.

Fees carried the most weight; every dollar you avoid in expenses stays in your child’s account, so low-cost plans earned the largest slice of points.

State tax perks came next. A generous deduction or credit puts cash back in your pocket the same year you contribute, so we rewarded programs that offer meaningful relief.

Performance ranked third. We looked at five-year returns for age-based portfolios, then cross-checked those figures against Morningstar’s November 2025 medal list, which Kiplinger reports named only five plans Gold.

Investment choice mattered too. Families want flexibility—index tracks for set-it-and-forget-it savers, specialty funds for hands-on investors. Plans that provide both without inflating costs scored high.

Finally, we graded ease of use. Quick online enrollment, no-minimum openings, and clean mobile apps can turn good intentions into real deposits.

If two plans tied, we tipped the scale toward the one with a recent fee cut, a newborn starter bonus, or an FDIC-insured option.

The result is a scoreboard that prioritizes what grows your balance: low costs, strong returns, valuable tax breaks, and zero hassle. In the next section you’ll see exactly how each top contender measured up.

The scorecard: how the top plans stack up

Numbers turn opinions into proof, so we rolled every data point into a single scoreboard. The chart below shows where each winning plan shines, and where it merely holds its own.

| 529 Plan | Fees* | State-tax benefit* | 5-year performance* | Investment choice* | Ease of use* | Total score (100) |

| Illinois Bright Start | 28 | 25 | 18 | 14 | 9 | 94 |

| Utah my529 | 27 | 22 | 19 | 15 | 8 | 91 |

| Pennsylvania PA 529 | 29 | 25 | 16 | 13 | 8 | 91 |

| New York Direct | 30 | 20 | 17 | 13 | 9 | 89 |

| Massachusetts U.Fund | 26 | 15 | 18 | 14 | 9 | 82 |

| Alaska 529 | 24 | 0 | 20 | 15 | 8 | 82 |

| Michigan MESP | 30 | 20 | 14 | 12 | 8 | 84 |

| California ScholarShare | 28 | 0 | 18 | 14 | 9 | 79 |

| Virginia Invest529 | 27 | 12 | 15 | 14 | 9 | 77 |

| Maryland College Invest | 23 | 10 | 19 | 13 | 8 | 73 |

*Scores reflect the maximum points assigned to each factor in our model.

A quick glance tells the story. Illinois’s Bright Start 529 and Utah’s my529 dominate on ultralow fees, while Pennsylvania catches them once state-tax relief enters the mix. Bright Start’s public fee table lists its Vanguard Total Stock Market Index portfolio at 0.08 percent a year, so a $10,000 balance pays about $8 in annual costs versus $30 or more in many rival plans—savings that can snowball into hundreds of extra tuition dollars over 18 years.

Alaska and Maryland earn their keep on raw performance even without a tax carrot. California proves that states offering no deduction can still deliver excellent value through low costs, smart fund design, and disciplined oversight.

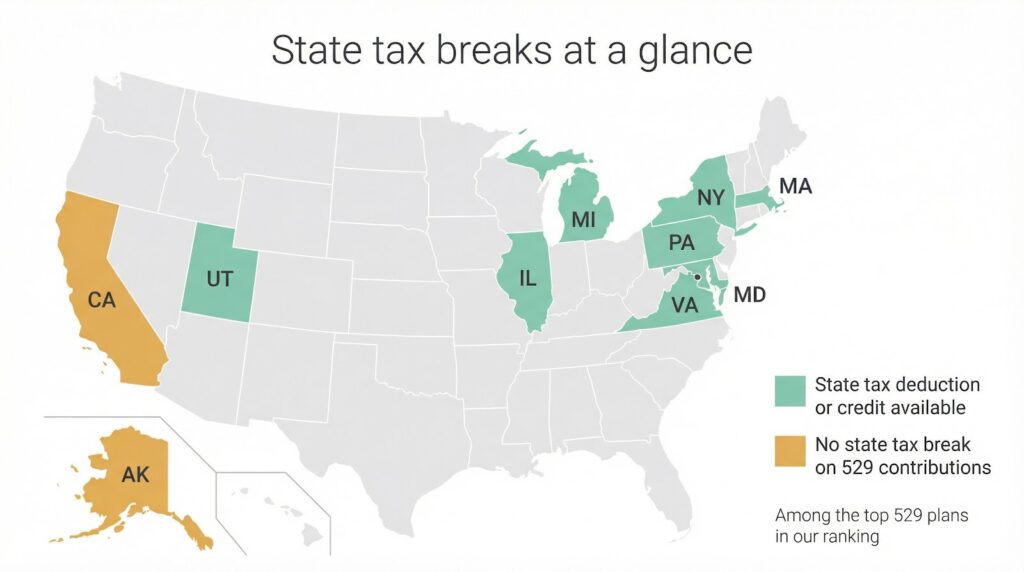

State tax breaks at a glance

A large state deduction can feel like an instant return on your college dollars, so we lined up the numbers side by side. Use this chart to see how much of your contribution you can shield from income tax if you stay local, then weigh that savings against fees and performance before you decide.

| State plan | Single filer deduction / credit | Joint filer deduction / credit | Quick take |

| Illinois Bright Start | $10,000 deduction | $20,000 deduction | Richest flat deduction on the list |

| Pennsylvania PA 529 | $18,000 per beneficiary | $36,000 per beneficiary | Sky-high cap; applies per child |

| New York Direct | $5,000 deduction | $10,000 deduction | Large tax savings in a high-tax state |

| Michigan MESP | $5,000 deduction | $10,000 deduction | Solid break plus ultralow fees |

| Utah my529 | 4.55 % credit on ≈ $2,500 | 4.55 % credit on ≈ $5,000 | Dollar-for-dollar credit, indexed yearly |

| Massachusetts U.Fund | $1,000 deduction | $2,000 deduction | Modest, but better than zero |

| Virginia Invest529 | $4,000 deduction* | $4,000 each owner* | Unlimited carry-forward of extra |

| Maryland College Invest | $2,500 deduction | $5,000 (split between two accounts) | Ten-year carry-forward on excess |

| Alaska 529 | None (no state income tax) | None | Low fees and top returns fill the gap |

| California ScholarShare | None | None | Relies on rock-bottom costs instead |

*Virginia lets you deduct any amount over the $4,000 cap in future years.

Figures reflect 2026 filing rules compiled by EducationData.org and state treasuries.

Tax perks are powerful, but they are only one lever. If your home state lands in our top tier, the deduction is hard to ignore. If it does not, you may still come out ahead by choosing a lower-fee, higher-return plan elsewhere and giving up the write-off.

1. Illinois Bright Start

Illinois tops our list because it combines rock-bottom costs with the richest state-tax break in the country. Annual expenses on its index portfolios sit near a whisper, so every contribution compounds at full speed.

Couples who live in Illinois can deduct up to $20,000 a year from state income, a direct and immediate return. Out-of-state families still join for the refreshed lineup that blends Vanguard index funds with active picks from managers such as T. Rowe Price.

The plan keeps friction low. Bright Start’s enrollment checklist shows that all you need is basic owner and beneficiary details such as name, Social Security number, and address. With that in hand, you can open a 529 account in minutes with as little as $25, fund it from payroll, and track progress through the ReadySave 529 app. New parents also receive a $50 seed deposit for every child born in the state, a small nudge that often jump-starts long-term saving habits.

In short, Bright Start checks every box: ultralow fees, generous tax perks, strong stewardship, and a friendly user experience that stays out of the way while you pay for college with fewer dollars out of pocket.

Quick stats

- Fees: ~0.08 %–0.42 %

- IL tax deduction: $10k single / $20k joint

- Investment tracks: age-based, all-index, multi-manager custom

- Minimum to open: $25

2. Utah my529: custom control, nickel-thin costs

Utah’s plan has earned a Morningstar Gold rating for 14 consecutive years, thanks to two pillars: microscopic fees and unrivaled flexibility.

Most portfolios cost about one-tenth of a percent per year, keeping market returns nearly intact. The standout feature is control: you can build a custom age-based glide path or select a fixed mix from Vanguard and Dimensional funds. Prefer an 85 / 15 stock-bond split that shifts to 60 / 40 by ninth grade? Set it in minutes.

Utah residents receive a modest credit of roughly $100 on a $5,000 contribution. Savers nationwide still join for the low costs and design freedom. You can open with $0, automate payroll deposits, and even crowd-fund birthdays through a gifting link.

Together, these perks make my529 ideal for investors who like to fine-tune without paying Wall Street prices.

Quick stats

- Fees: ~0.10 %–0.40 %

- UT tax credit: 4.55 % on first $2,500 single / $5,000 joint

- Investment tracks: pre-built or fully custom glide paths

- Minimum to open: $0

3. Pennsylvania PA 529: big deductions, Vanguard simplicity

Pennsylvania’s plan delivers two key advantages: a large state deduction and the steady reliability of Vanguard index funds. Residents can shelter up to $18,000 per child from state income each year, or $36,000 for married couples, so even large front-loaded gifts slide in tax-free.

Inside, age-based portfolios lean on Total Stock, Total International, and Total Bond funds, all priced near 0.10 %. You can also build your own mix from 16 single-fund options that let you tilt toward small-caps, TIPS, or cash.

Returns track the market with minimal drama, and the state treasury keeps fees falling; another trim is already scheduled as assets grow.

Open an account with $25, set contributions on autopilot, and you may forget the plan exists—until you see how quickly balances climb when taxes and high fees stay out of the picture.

Quick stats

- Fees: ~0.10 %–0.20 %

- PA tax deduction: $18k single / $36k joint per beneficiary

- Investment tracks: age-based, risk-based static, 16 individual funds

- Minimum to open: $25

4. New York Direct Plan: Vanguard precision, city-size savings

New York’s plan shows that one trusted provider can be enough. Vanguard runs every portfolio, and a recent fee cut drives total expenses to about 0.11 % per year—cheaper than many index ETFs.

Empire State residents can deduct up to $10,000 of annual contributions if they file jointly, an instant benefit given New York’s high brackets.

The investment menu stays simple by design. Age-based “enrollment year” tracks glide from 90 % stocks in diapers to nearly all bonds by senior year. If you prefer to tinker, 21 individual portfolios let you dial in U.S. equity, international, or short-term reserves.

Account setup takes minutes and no minimum deposit. Link a bank account, schedule automatic pulls, and let the plan compound quietly in the background.

Quick stats

- Fees: ~0.11 % flat

- NY tax deduction: $5k single / $10k joint

- Investment tracks: ten enrollment-year funds, 21 static options

- Minimum to open: $0

5. Massachusetts U.Fund: Fidelity choice with a personal touch

Think of the U.Fund as a custom mix built on Fidelity’s low-cost toolkit. You decide whether to lean fully on index funds, sprinkle in active managers, or blend the two for a smoother ride. Each path costs around 0.10 % on the index track or about 0.50 % on the all-active track, so expenses never drag on growth.

The state deduction is smaller than Illinois or Pennsylvania—up to $2,000 for joint filers—but still puts real money back every April. Add zero account fees, and you have a clean, friction-free path to compounding.

Governance helps too. Massachusetts reviews fees and performance regularly, a structure Morningstar calls “scrupulous.” When Fidelity trims costs in its retirement lineup, the U.Fund often follows.

The online experience mirrors Fidelity’s retail platform, letting you track your 529 alongside a brokerage or 401(k). You can start with $50, or just $15 if you automate contributions.

Quick stats

- Fees: ~0.10 % on index track, ~0.50 % on all-active

- MA tax deduction: $1k single / $2k joint

- Investment tracks: all-index, all-active, or blended age-based series

- Minimum to open: $50 ($15 with autopay)

6. Alaska 529: active edge in a no-tax state

Alaska levies no state income tax, so this plan competes on pure investment muscle. T. Rowe Price manages every portfolio, relying on time-tested active funds that averaged about 9 % a year over the past five years, topping many index peers.

Fees run higher than all-index options yet remain below 0.70 %. That premium has rewarded growth-minded savers with consistent out-performance.

With no deduction to lose, the plan appeals to residents of any no-tax or low-benefit state. You can open an account with $25, choose an age-based or sector-tilted track, and track progress through T. Rowe Price’s intuitive online portal.

Quick stats

- Fees: ~0.38 %–0.67 %

- State tax break: None (no income tax)

- Investment tracks: active age-based, specialty equity, bond, money market

- Minimum to open: $25

7. Michigan MESP: safety first, fees to match

Michigan’s Education Savings Program attracts savers who value principal protection. Alongside stock-focused tracks, the plan offers a guaranteed option that pays at least 1 % interest and charges no asset fee. When markets dip, that floor can ease nerves.

Growth portfolios stay lean; index-based age tracks cost about 0.07 % a year, keeping long-term performance on track. Add a state deduction of up to $10,000 for couples, and every deposit starts with an immediate boost.

Opening an account takes $25, or $15 if you automate contributions. The TIAA dashboard is simple and quick to navigate. You can view balances, contributions, and goal progress at a glance, then return to daily life.

Quick stats

- Fees: ~0.07 %–0.13 % (0 % on guaranteed portfolio)

- MI tax deduction: $5k single / $10k joint

- Investment tracks: three age-based, balanced static, individual index funds, guaranteed option

- Minimum to open: $25 ($15 with autopay)

8. California ScholarShare: no deduction, no problem

California offers no state tax break, yet its ScholarShare plan still earns a spot through disciplined costs and smart design. Index portfolios charge as little as 0.04 %, and even active-tilt tracks rarely top 0.40 %.

Flexibility is a draw. You can choose classic enrollment-year portfolios, static index mixes, or an ESG series for families who value sustainability. All carry the same low program fee, so values-based investing never forces you to overpay.

Open an account with $0, set automatic contributions, and invite relatives to chip in through the Ugift link. The interface is clean and fast, encouraging consistent deposits.

Quick stats

- Fees: ~0.04 %–0.39 %

- State tax break: None

- Investment tracks: enrollment-year, static index, ESG series, single-fund choices

- Minimum to open: $0

9. Virginia Invest529: diverse choices with carry-forward perks

Invest529 offers one of the broadest menus in the country. You can choose no-frills index funds, seasoned active blends, or even an FDIC-insured cash sleeve for money you will need next semester. Most index portfolios cost under 0.15 %, and the priciest active mixes top out near 0.55 %, a fair premium for added management.

Virginia residents can deduct $4,000 per account each year. Contribute more and any excess carries forward indefinitely, so large deposits still capture every tax-favored dollar. Out-of-state investors often join for the variety: real-estate and small-cap funds appear here when many plans stick to basic building blocks.

The online portal is polished, the minimum to start only $10, and automatic payroll links make set-and-forget saving easy. In short, Invest529 delivers options today and flexibility tomorrow without letting costs creep up.

Quick stats

- Fees: ~0.02 %–0.55 %

- VA tax deduction: $4,000 per account, unlimited carry-forward

- Investment tracks: enrollment-year, passive and active static mixes, REIT, FDIC cash

- Minimum to open: $10

10. Maryland College Investment Plan: performance powered by T. Rowe Price

Maryland relies on home-grown talent, placing portfolio management with T. Rowe Price, and the numbers confirm the decision. Active managers have steered age-based tracks to top-tier five-year returns while keeping fees reasonable for an active approach.

The state deduction is smaller than Pennsylvania’s at $2,500 per beneficiary ($5,000 split between two owners), but unused amounts carry forward for 10 years, giving families plenty of runway to capture every dollar. Pair that tax perk with strong gains, and the math still favors Maryland residents.

Investment choice stays streamlined. Select an enrollment track, a static mix, or park short-term cash in a U.S. Treasury money market fund. Simplicity keeps decisions quick when college is approaching.

Open an account with $25, manage everything through T. Rowe Price’s online portal, and enjoy a rare mix of active edge and disciplined costs.

Quick stats

- Fees: ~0.38 %–0.67 %

- MD tax deduction: $2,500 per beneficiary ($5,000 split for two owners)

- Investment tracks: age-based active, static risk mixes, Treasury money market

- Minimum to open: $25

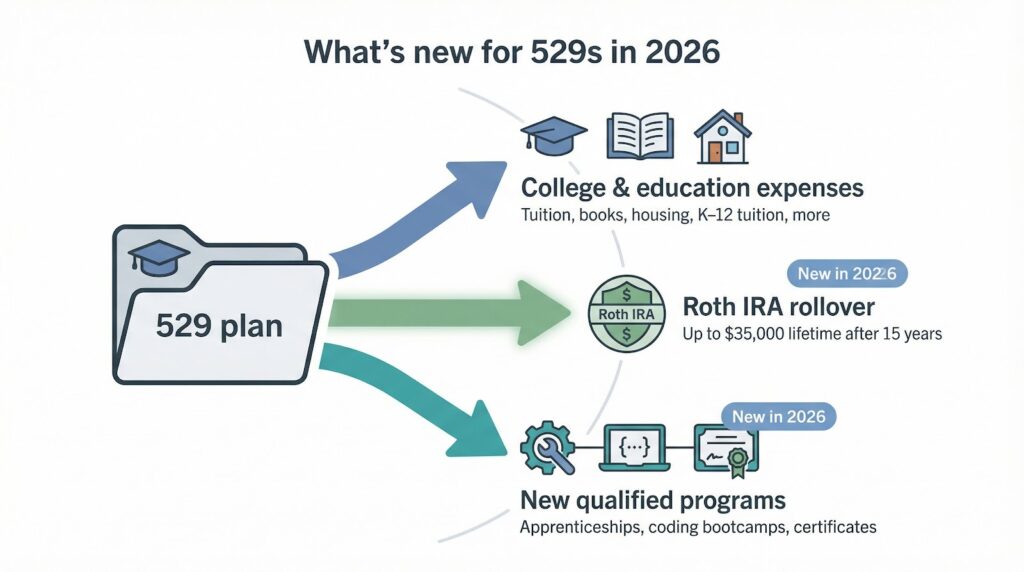

What’s new for 529 plans in 2026?

Rules around 529s seldom sit still, and the past two years rewrote several chapters. Before you choose a plan, review the biggest changes shaping these accounts today.

Federal law expands 529 flexibility.

Congress tucked two breakthrough provisions into recent legislation.

First, the SECURE 2.0 Act now lets unused 529 money roll into a Roth IRA for the beneficiary, tax and penalty free, up to $35,000 over a lifetime. The 529 must be at least 15 years old, and annual Roth contribution limits still apply, but the rule removes the old fear of over-saving.

Second, the One Big Beautiful Bill Act broadened the definition of qualified expenses. Beginning this year, you can use 529 funds for approved apprenticeship fees, coding boot camps, and many professional certificates. College is no longer the only on-ramp that qualifies for tax-free growth and withdrawals.

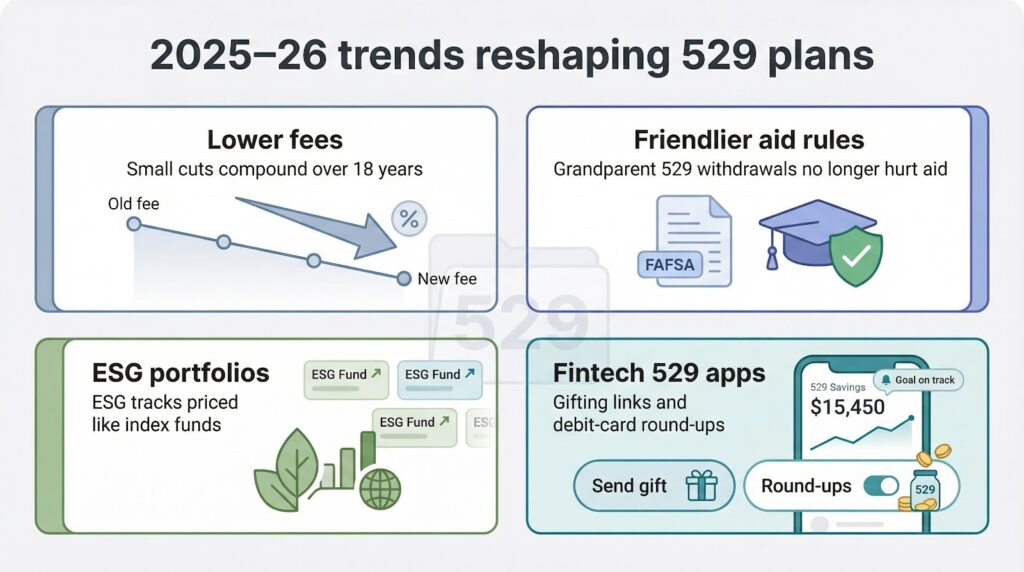

Additional updates, including lower fees, FAFSA fixes, and more ESG portfolios, appear in the next subsection.

More 2025–26 trends reshaping your strategy

Lower fees everywhere. Big plans from New York to Oregon trimmed expenses by 2–5 basis points last year. That barely moves daily returns, but over 18 years it can keep hundreds of dollars in your pocket. Check your statement; your plan may already cost less than it did a quarter ago.

FAFSA gets friendlier. Beginning with the 2024–25 aid cycle, withdrawals from grandparent-owned 529 accounts no longer count as student income. Grandma can help with tuition without hurting need-based aid, so involve the whole family in funding goals.

ESG goes mainstream. California, Illinois, and Oregon now run full enrollment-year tracks built around environmental and social screens. Fees match traditional index funds, so you do not pay extra to align with your values.

Fintech finishes the job. Most state plans now connect to the ReadySave 529 app, which shows balances, lets relatives send gifts in seconds, and nudges you when you fall behind your monthly target. A few programs even round up everyday debit-card purchases into your 529, turning spare change into textbook money.

Taken together, these shifts make 2026 one of the most consumer-focused moments in the history of 529 plans. Use the new rules, lower costs, and smarter tech to accelerate your saving pace while the window is open.

Quick answers to your biggest 529 questions

What if my child skips college?

You have options. You can name a new beneficiary in the family without taxes or penalties, apply up to $10,000 toward student loans, or roll as much as $35,000 into the beneficiary’s Roth IRA once the account reaches 15 years. If you withdraw for non-qualified reasons, you pay income tax on earnings plus a 10 percent penalty—only on the growth, never on your original contributions.

Will a 529 hurt our financial-aid chances?

Not by much. Parent-owned 529 balances count as a parental asset on the FAFSA, and the calculation taps at most 5.64 percent of that value. Withdrawals from parent or student accounts no longer reduce aid, and new FAFSA rules also exclude grandparent-owned distributions. In practice, the benefit of tax-free growth outweighs the modest impact on aid formulas.

What expenses qualify in 2026?

Far more than tuition. You can pay for required books, a laptop, on- or off-campus housing (up to the school’s published allowance), K-12 tuition up to $10,000 per year, certain apprenticeship costs, and a lifetime $10,000 slice of student loans. The latest law also covers many certificate and coding-boot-camp fees. Keep receipts and match withdrawals to costs in the same calendar year to stay in the clear with the IRS.

Conclusion

Taken together, these shifts make 2026 one of the most consumer-focused moments in the history of 529 plans. Use the new rules, lower costs, and smarter tech to accelerate your saving pace while the window is open.