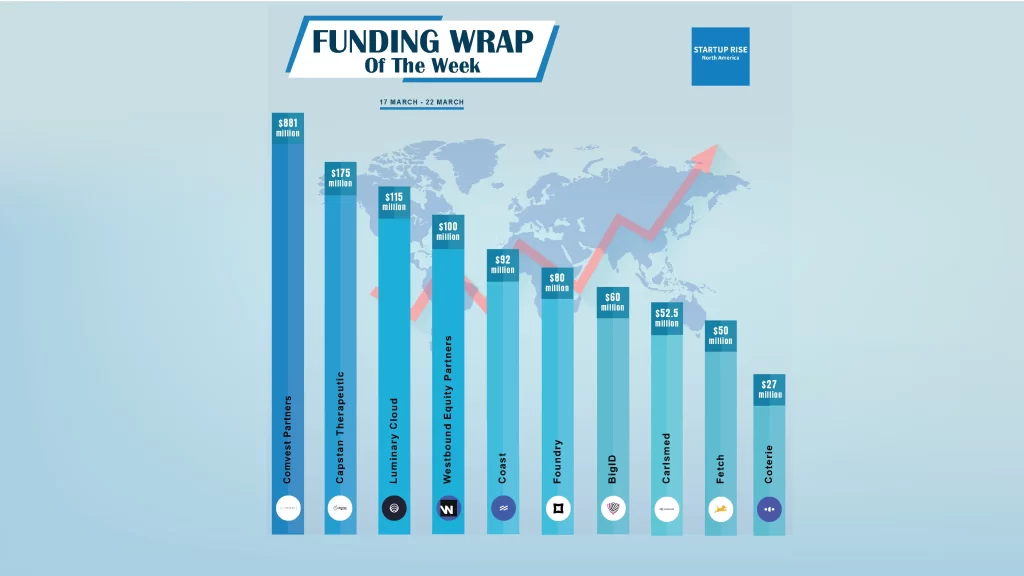

There are a lot of North American startups funding deals that are creating buzz around the startup ecosystem. These are the growth-stage and early-stage deals of this week. Let’s talk about the Top 10 Funding deals.

The Top 10 North American Startups Funding Deals

Table of Contents

Comvest Partners

Comvest Partners, a West Palm Beach, middle-market private equity and credit investment firm, secure its sixth flagship private equity fund, Comvest Investment Partners VI, at $881M.

Comvest Partners is an operationally focused private investment firm that has provided equity and debt capital to well-positioned middle-market companies throughout North America since 2000.

Capstan Therapeutics

Capstan Therapeutics, a biotechnology company dedicated to advancing in vivo reprogramming of cells through RNA delivery using targeted lipid nanoparticles, secures $75million in series B round funding.

The Series B financing was led by RA Capital Management, with participation from new investors Forbion, Johnson & Johnson Innovation – JJDC, Mubadala Capital, Perceptive Advisors, and Sofinnova Investments. Capstan’s existing investors Alexandria Venture Investments, Bristol Myers Squibb, Eli Lilly and Company, Leaps by Bayer, Novartis Venture Fund, OrbiMed, Pfizer Ventures, Polaris Partners, and Vida Ventures, also participated in the round.

Capstan is a biotechnology company with a mission to multiply the therapeutic possibilities for patients by developing targeted in vivo RNA technologies. The core platform technology comprises proprietary targeted lipid nanoparticles (tLNP) that are composed of LNPs conjugated with a recombinant protein binder, such as a monoclonal antibody.

Luminary Cloud

Luminary Cloud, cloud-native, computer-aided engineering (CAE) software provider secures $115million in funding. Lead investor in the round was Sutter Hill Ventures.

The first contemporary computer-aided engineering software as a service platform in the world, Luminary Cloud gives engineers insights in minutes, enabling hitherto impractical speeds of simulation, analysis, and iteration. This is known as real-time engineering.

Westbound Equity Partners

Westbound Equity Partners Early Stage Venture Capital Firm secures its second fund, at $100million. At their founding five years ago, they set out on an ambitious journey with a bold vision: to close the racial wealth gap by building a virtuous cycle of wealth and opportunity by investing financial and social capital into exceptional founders and ventures led by, solving problems for, or built with underrepresented people of color.

Westbound Equity Partners is an early-stage fund that invests in businesses that serve minority customers, capitalizes underrepresented entrepreneurs, and assists early-stage companies in assembling diverse teams.

Coast

Coast, a company offering a way to manage fuel and fleet spending secures $92million in equity and committed debt capital. The new equity capital comes from their existing investors: BoxGroup, Avid Ventures, Accel, Insight Partners, and Better Tomorrow Ventures. The debt capital comes from Silicon Valley Bank as well as TriplePoint Capital.

Fuel and fleet payments simplified. With Coast, you can effortlessly manage and monitor your expenses – it’s a flexible, fair card that works everywhere. They think that better is due to fleets. Fleet managers have wasted time and money fretting about manual spend reporting and erroneous purchases.

Foundry

Foundry, a new breed of public cloud for AI/ML workloads secures $80million in seed and series A round funding to coordinate the world’s computational capability, making it usable and accessible to everyone. Along with participation from Redpoint, Microsoft Ventures (M12), Conviction, NEA, and other top technical and business experts in the field, Sequoia Capital and Lightspeed Venture Partners co-led the round.

Foundry, Founded by former members of the core Deep Learning Team at DeepMind and the Stanford CS PhD programme (under the direction of Matei Zaharia, co-founder of Databricks), Foundry addresses the fundamental technological and economic issues in AI and deep learning.

BigID

BigID, AI-augmented data security company secures $60million in growth funding. Riverwood Capital led the round, which raised a total of $320 million at a valuation of over $1 billion. Silver Lake Waterman and Advent also participated. The funding will be used by the business to expedite both inorganic and organic growth in AI data security and compliance.

BigID is a pioneer in data security and compliance for the public and private cloud, helping to define new data security product categories like DSPM (Data Security Posture Management) and redefine categories like Data Discovery, Data Classification, Data Loss Prevention and and Data Access Management.

Carlsmed

Carlsmed, an AI-enabled personalized surgery Medtech company secures $52.5million in series C round funding. This round was co-led by B Capital and U.S. Venture Partners.

Carlsmed creates customized aprevo® spine fusion devices and the best surgical strategies for each patient using patient data and exclusive digital technology. Commercially available in the United States, the Carlsmed® aprevo® devices have received FDA clearance and FDA Breakthrough Designation, an unprecedented honor for any implanted device in the industry.

Fetch

Fetch, provider of a rewards app secures $50million in debt funding from Morgan Stanley Private Credit. This infusion of capital will prime Fetch for another year of aggressive growth as the now-profitable company accelerates its journey to become the world’s first rewards-for-everything platform.

The top platform for engaging consumers in America is called Fetch, which pays customers to purchase the goods they adore. Users can save the most on regular purchases by just scanning their receipts with the Fetch app.

Coterie

Coterie, the insurtech MGA simplifying small business insurance secures $27million in growth funding. The oversubscribed round includes new investment from Hiscox as well as existing investors Intact Ventures, Weatherford Capital, and RPM Ventures among others.

Coterie Insurance provides rapid small company insurance writing to independent agents and brokers in all 50 states as well as Washington, D.C. It provides precise pricing and a submission-to-bind experience in less than a minute, thanks to its data-backed underwriting.

These startups played a major role in North American Startups Funding ecosystem in this week and secured funding from Venture Capitalists, Angle Investors in different funding Rounds.

Frequently asked questions (FAQs)

Name the Top North American Startups Funding Deals in This Week?

Comvest Partners, Capstan Therapeutics, Luminary Cloud, Westbound Equity Partners, Coast, Foundry, BigID, Carlsmed, Fetch, Coterie, are the Top 10 North American Startups Funding Deals of This Week.