What is the concept of buy now pay later in a startup?

“Buy Now, Pay Later” (BNPL) is a financial business concept popular among entrepreneurs that allows customers to purchase goods or services now and pay later. When customers select this option at the checkout, the entire payment is split into interest-free installments.

Read also – Top 10 Best HR Tech Startups in the USA

In the ever-changing financial world, BNPL delivers budget flexibility, raises sales for businesses, and improves customer loyalty, all while transforming how customers manage their finances and make purchases.

Top 10 Buy Now Pay Later (BNPL) startups in the USA

Table of Contents

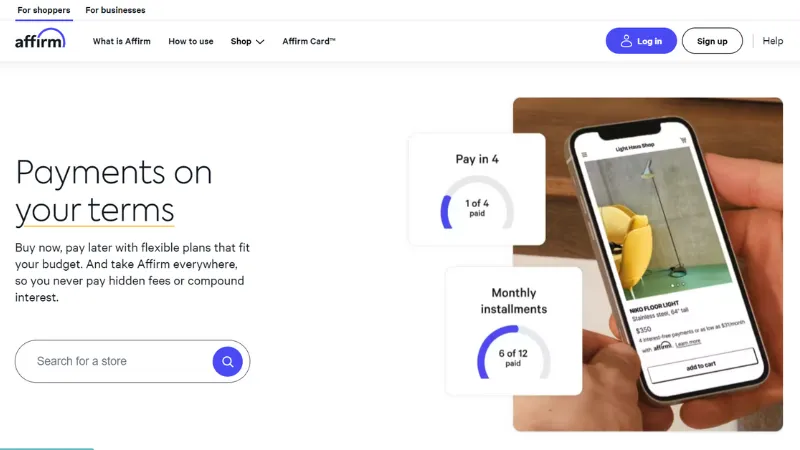

Affirm

Affirm, established in 2012 by Max Levchin, Nathan Gettings, and Jeff Kaditz, is a revolutionary Buy Now Pay Later (BNPL) enterprise situated in San Francisco, California. It reimagines the consumer purchasing experience by providing clear, interest-free point-of-sale financing, offering an alternative to traditional credit cards.

Read also – Top 20 Best Electric Vehicles (EV) Startups in the USA

Affirm’s popularity stems from its commitment to financial flexibility and transparent, ethical purchasing practices, reshaping how people approach shopping and payments in the United States.

Afterpay

Afterpay, founded in 2014 by Nick Molnar and Anthony Eisen, is a well-known BNPL firm offering distinctive payment alternatives. Headquartered in Sydney, Australia, and with a significant presence in the United States.

Read also – Top 10 Best Crowdfunding Platforms in USA

Afterpay enables customers to split payments into four equal installments, providing a seamless and interest-free alternative to conventional credit. The company’s success lies in its adaptability to evolving consumer preferences, delivering a modern and cost-effective approach to transactions.

Sezzle

Sezzle, established in 2016 by Charlie Youakim and Paul Paradis, is a dynamic BNPL platform that allows interest-free payments without traditional credit checks. Based in Minneapolis, Minnesota, Sezzle empowers buyers financially while aiding them in building or repairing their credit ratings.

Read also – Top 10 Defence Tech Startups in USA

The company’s dedication to financial inclusion and its smooth integration with e-commerce platforms underline its role in meeting the increasing demand for BNPL solutions.

Klarna

Klarna, founded in 2005 by Sebastian Siemiatkowski, Niklas Adalberth, and Victor Jacobsson in Stockholm, Sweden, has significantly influenced the American industry. Klarna provides diverse BNPL services, permitting users to split payments into four interest-free installments.

Read also – TOP 10 Spacetech Startups in the USA

With a user-friendly app and global reach, Klarna has gained popularity in the United States by offering a convenient shopping experience and enhancing payment simplicity and security.

QuadPay

Quadpay is acquired by a Zip company, QuadPay, established in 2017 by Adam Ezra, Brad Lindenberg, and Tommy Nicholas, is a BNPL platform that empowers customers to divide purchases into four interest-free payments over six weeks.

Read also – Top 10 Agri-tech Startups in the USA

QuadPay, based in New York, seamlessly interacts with numerous online and physical businesses, delivering a simple and flexible payment option at the point of purchase. Its popularity arises from a user-friendly interface and an extensive network of merchant partners.

Splitit

Splitit, founded in the United States, provides a distinctive BNPL service allowing customers to split purchases into interest-free monthly installments using their existing credit cards.

Read also – Top 10 AI Copywriting Tools

Founded by Gil Don, Alon Feit, and Matan Bar, Splitit’s technology integrates seamlessly with online and in-store retail platforms, offering a flexible payment alternative. This approach eliminates the need for additional credit checks, contributing to its popularity among consumers and merchants.

PayPal Credit

Originally known as Bill Me Later, PayPal Credit is a digital credit line service offered by PayPal. Although specific founders are not mentioned, PayPal Credit evaluates customers’ creditworthiness during the transaction, eliminating the need for a traditional credit application.

Read also – Berlin-based UltiHash Secures $2.5m in Pre-Seed Funding

Integrated with the PayPal platform, this service enhances purchasing power and benefits e-commerce firms by improving sales and customer loyalty.

FuturePay

FuturePay, a BNPL system founded by Bobbi Leach, enables customers to make online purchases and spread payments over a specific period. With interest-free payment options, FuturePay provides an economical and flexible shopping experience.

Read also – Boston-based knownwell Secures $20m in Series A Round Funding

By seamlessly integrating into e-commerce websites, FuturePay assists online businesses in increasing conversion rates and average order values, promoting financial accessibility in the digital retail environment.

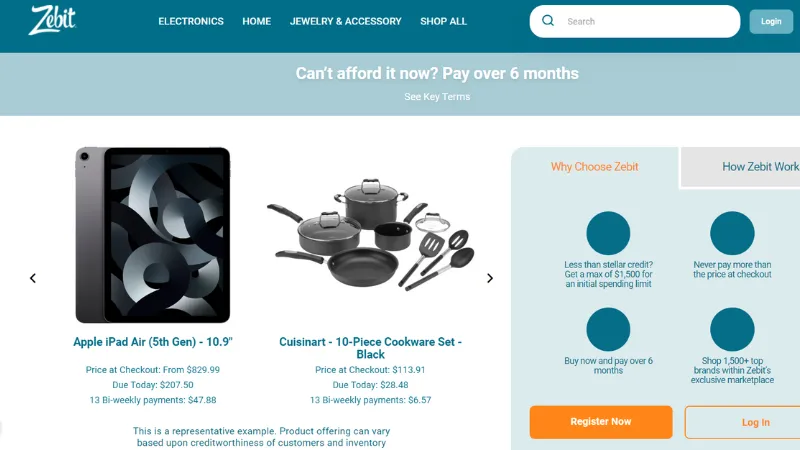

Zebit

Zebit, a distinctive e-commerce and financial technology platform, specializes in providing BNPL services to individuals with restricted access to traditional credit.

Read also – Cambridge-based Formless Secures $2.2M in Pre-Seed Funding

Founded by Marc Schneider and Michael Thiemann, Zebit does not base loan approvals on credit ratings but on an individual’s ability to repay over time. This inclusive and customer-centric BNPL solution offers financial freedom and ethical purchasing options.

Lemonade Finance

Lemonade Finance, a digital financing platform, offers simple and convenient BNPL services.

Read also – CA-based Cisco is to Acquire Isovalent

While specific founders are not mentioned, Lemonade Finance focuses on transparency and simplicity, enabling users to make informed financial decisions while enjoying the flexibility of delayed payments for their purchases.

Frequently asked questions (FAQs)

What are the top 10 Buy Now Pay Later (BNPL) startups in the USA?

Affirm, Afterpay, Sezzle, Klarna, QuadPay, Splitit, PayPal Credit, FuturePay, Zebit, Lemonade Finance, these are top 10 Buy Now Pay Later (BNPL) startups in the USA.

When Affirm was founded?

Affirm was founded in 2012.

Who is the founder of Afterpay?

Afterpay is founded by Nick Molnar and Anthony Eisen.