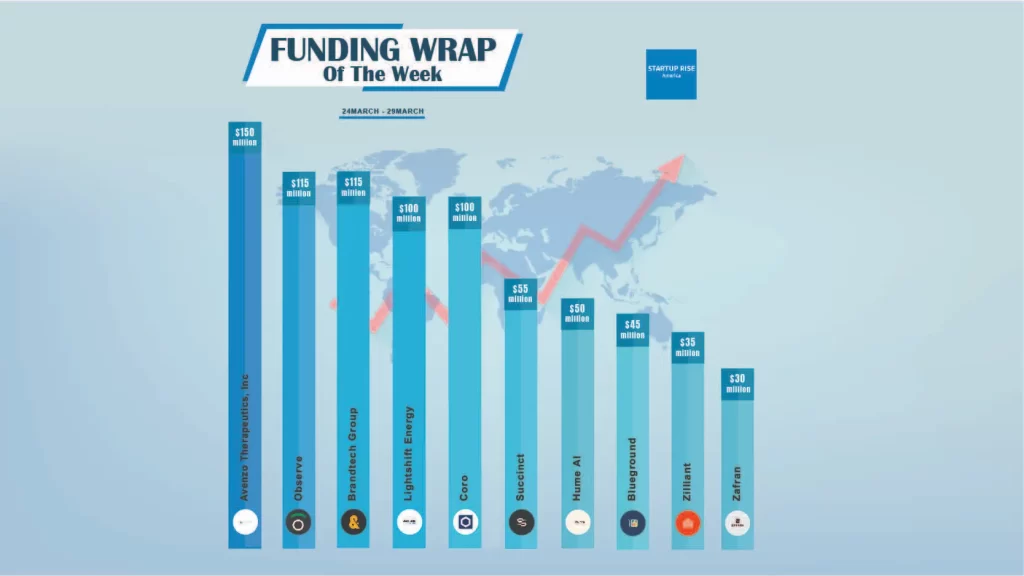

There are a lot of American startups funding deals that are creating buzz around the startup ecosystem. These are the growth-stage and early-stage deals of this week. Let’s talk about the Top 10 Funding deals.

The Top 10 American Startups Funding Deals

Table of Contents

Avenzo Therapeutics, Inc

Avenzo Therapeutics, Inc, a clinical-stage biotechnology company developing next generation oncology therapeutics secures $150million in series A-1 round funding.

With the participation of additional investors INCE Capital, TF Capital, Delos Capital, and Quan Capital, the round headed by additional Enterprise Associates (NEA), Deep Track Capital, Sofinnova Investments, and Sands Capital secured a total of $347 million in fundraising to far. Jakob Dupont, M.D., Executive Partner, Private Equity, Sofinnova Investments, will join the Avenzo Board of Directors concurrently with the announcement.

Avenzo Therapeutics was founded by Drs. Athena Countouriotis and Mohammad Hirmand in 2022, a clinical-stage biotechnology business. The company is developing and expanding a pipeline of possibly best-in-class cancer treatments that aim to stop the abnormal cell growth that is the main cause of many malignancies by targeting cell cycle control.

Observe

Observe, a SaaS observability company secures $115million in series B round funding. Sutter Hill Ventures led the investment, including participation from new investor Snowflake Ventures as well as current investors Capital One Ventures and Madrona.

In November 2017, Sutter Hill Ventures launched Observe. Leading enterprise SaaS and software firms like Snowflake, Splunk, and Wavefront—which handle enormous amounts of data—made up their founding team.

Brandtech Group

Brandtech Group generative AI marketing company secures $115million in funding. Fimalac, Nendo Labs, Mousse Partners, and the Bansk Group are among the backers.

The Brandtech Group is the top global generative AI marketing firm and the world’s top digital-only marketing group. David Jones, the former CEO of Havas Global, started it in June 2015 under the name You & Mr. Jones with the straightforward goal of assisting brands in leveraging technology to market their products more effectively, more quickly, and more affordably.

Lightshift Energy

Lightshift Energy formerly known as Delorean Power secures $100million in funding Greenbacker Capital Management. The company has secured $20M from a GCM-affiliated investment vehicle dedicated to making growth equity investments in sustainable infrastructure development platforms.

Lightshift Energy, formerly Delorean Power, is a utility-scale energy storage development company with headquarters in Arlington, Virginia. Founded in 2019 and backed by funds managed by Greenbacker Capital Management, Lightshift is developing a diverse pipeline of energy storage projects, ranging in size up to 250 MW across the US.

Coro

Coro, the leading cybersecurity platform purpose-built for small and medium-sized enterprises (SMEs) raises $100million in series D round funding. This round was led by One Peak, with participation from existing investors Energy Impact Partners and Balderton Capital. This funding round brings the total funds raised to $255 million in the last 24 months.

Coro, the leading cybersecurity platform for the SME market, revolutionized cybersecurity with the introduction of the world’s first modular cybersecurity platform in 2023. It’s platform empowers organizations to easily defend against malware, ransomware, phishing, data leakage, network threats, insider threats and email threats across devices, users, networks and cloud applications.

Succinct

Succinct, a developer of zero-knowledge proof tools. secures $55million in seed and series A round funding. In addition to Robot Ventures, Bankless Ventures, Geometry, ZK Validator, and angel investors Sreeram Kannan from Eigenlayer, Sandeep Nailwal, Daniel Lubarov from Polygon, and Elad Gil, the round was led by Paradigm.

Succinct, The first fully open-source ZKVM that is competitive with custom ZK circuits is called SP1. With SP1, developers can swiftly iterate with auditable and maintainable code, use ZK with standard programming languages, and reuse pre-existing crates and libraries.

Hume AI

Hume AI, a startup and research centre that develops artificial intelligence optimised for human well-being secures $50million in series B round funding. Lead investors in the round were EQT Ventures, Union Square Ventures, Comcast Ventures, Nat Friedman & Daniel Gross, Metaplanet, Northwell Holdings, and LG Technology Ventures.

Hume wants to pave the way for a time when technology will better support human objectives by using a knowledge of human emotion. The company’s objective includes conducting innovative scientific research that is published in prestigious scientific publications and supporting The Hume Initiative, a non-profit that has produced the first practical ethical standards for AI with empathy.

Blueground

Blueground global operator of furnished, flexible rentals for 30+ day stays secures $45million in series D round funding. WestCap and Susquehanna Private Equity Investments, two new investors, were among those who contributed to the round.

A multinational proptech business called Blueground is revolutionising how people live. Blueground offers its carefully selected network of thousands of high-quality, fully furnished homes in popular neighbourhoods worldwide, making it available for visits lasting one month or more.

Zilliant

Zilliant, a leader in pricing lifecycle management secures $35million in funding from Madison Dearborn Partners. The money will be used by the business to expedite product improvements and other expansion plans.

Zilliant manages the whole pricing lifecycle with industry-leading CPQ, price management & optimisation, and revenue intelligence solutions, assisting businesses in placing pricing at the centre of their operations.

Zafran

Zafran, the leader in risk and mitigation secures over $30million in funding. The funding was led by Sequoia Capital and Cyberstarts, with participation from Cerca Partners and Penny Jar.

Zafran is the market leading platform for risk and mitigation, mobilizing existing security controls to protect organizations during critical exploitation windows. The platform determines vulnerability exploitability, correlating control configuration, runtime, internet exposure, and threat intelligence exploit analysis.

These startups played a major role in American Startups Funding ecosystem in this week and secured funding from Venture Capitalists, Angle Investors in different funding Rounds.

Frequently asked questions (FAQs)

Name the Top American Startups Funding Deals in This Week?

Avenzo Therapeutics, Inc, Observe, Brandtech Group, Lightshift Energy, Coro, Succinct, Hume AI, Blueground, Zilliant, Zafran, are the Top 10 North American Startups Funding Deals of This Week.