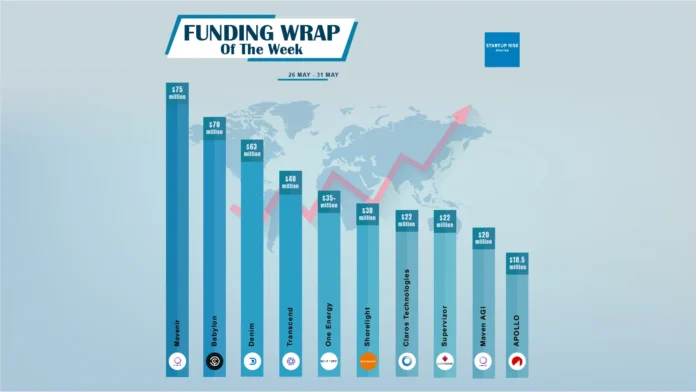

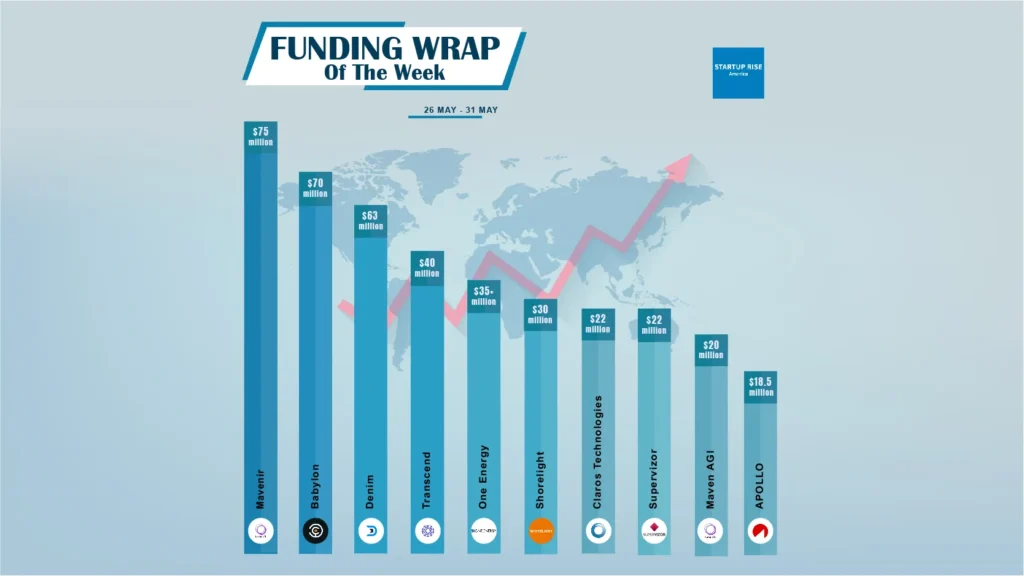

There are a lot of American startups funding deals that are creating buzz around the startup ecosystem. These are the growth-stage and early-stage deals of this week. Let’s talk about the Top 10 Funding deals.

The Top 10 American Startups Funding Deals

Table of Contents

Mavenir

Mavenir, the cloud-native network infrastructure provider building the future of networks, secures $75million in funding from an existing investor. The additional capital will drive it’s business strategy, anchored in end-to-end 5G transformation.

Mavenir is building the future of networks today with cloud-native, AI-enabled solutions which are green by design, empowering operators to realize the benefits of 5G and achieve intelligent, automated, programmable networks.

Babylon

Babylon , a company that aims to build a Bitcoin-secured decentralized world, secures $70million in funding. With participation from Bullish Capital, Polychain Capital, and additional investors, Paradigm led the round.

Babylon, they see a world in which Proof-of-Stake (PoS) chains coexist peacefully with Bitcoin. Their goal is to create a decentralised society powered by Bitcoin by advancing the cryptocurrency to become a reliable security foundation for proof-of-work chains, generating profits for its owners, and promoting a decentralised, safe, and interconnected economy.

Denim

Denim, a technology factoring partner for freight brokers, secures $63million in Warehouse Facility The funding was provided by Trinity Capital Inc. and Silicon Valley Bank (SVB).

Denim is a comprehensive financial services platform that is quickly upending the $250 billion freight intermediary industry. Freight brokers may streamline their financing operations and get the working capital they require to expand with ease thanks to their patented technology.

Transcend

Transcend, a data privacy platform provider, secures $40million in series B round funding. New investor StepStone Group led the round, which raised a total of around $90 million. Other investors included HighlandX, Accel, Index Ventures, 01 Advisors (01A), Script Capital, and South Park Commons.

Transcend is a privacy platform that enables organisations to strengthen customer interactions and regulatory postures for future regulations by implementing consent, control, and respectful, compliant data disclosure.

One Energy

One Energy, a industrial power company and installer of on-site, behind-the-meter, wind energy in the United States secures $35+million in series A round funding.

North America’s largest installation of on-site wind energy is One Energy, an industrial power firm. One Energy created contemporary energy services like Wind for Industry® and Managed High Voltage to reduce expense and risk after realising that major commercial and industrial energy consumers were tired with the shortcomings of legacy utilities.

Shorelight

Shorelight, a enrollment and performance management platform that drives international student success at top universities, secures $30million revolving facility with CIBC Innovation Banking.

In the US, one of the top marketplaces for international students is Shorelight. To promote student enrollment and performance at scale, their platform links institutions, service providers, and international students. Their goal is for future generations to be led and prospered by a population that is more globally diverse.

Claros Technologies

Claros Technologies, the leader in PFAS analytical and destruction technologies, secures $22million in new funding co-led by Ecosystem Integrity Fund and American Century Investments.

Founded from technical research developed at the University of Minnesota, Claros Technologies is harnessing green chemistry and advanced material science to solve their global human health PFAS pollution crises.

Supervizor

Supervizor, a company that offers finance teams a plug-and-play quality assurance platform, has raised $22 million in capital. Orange Ventures led the round, and Wille Finance, La Maison Partners, Adelie Capital, New Alpha Asset Management, and ISAI also participated.

Supervizor’s goal is to automate financial anomaly identification so that companies may better foster trust. Supervizor is the industry-leading solution for complete, automatic, and ongoing fraud and error monitoring. Bid adieu to ineffective sampling and manual controls.

Maven AGI

Maven AGI ,a customer support startup secures $20million in series A round funding. Leading the investment were M13, with participation from Lux Capital, MIT’s E14 Fund, and leaders from HubSpot, OpenAI, Google, and Stripe.

Maven AGI, Their platform creates artificial intelligence (AI) agents to use the potential of generative AI (Gen AI) to improve the enterprise customer experience. Their approach to customer service is entirely new, focusing on providing individualised user experiences with previously unheard-of precision and effectiveness.

APOLLO

APOLLO a digital insurance provider and leading innovator in the emerging embedded finance sector, is pleased to announce the creation and launch of FinShore, a wholly owned buy-now-pay-later subsidiary secures CAD $18.5 million in funding.

APOLLO Insurance is Canada’s leading online insurance provider. Their proprietary platform allows insurance agents and their customers to purchase their policy immediately, from anywhere, on any device, 24/7.

Frequently asked questions (FAQs)

Name the Top American Startups Funding Deals in This Week?

Mavenir, Babylon, Denim, Transcend, One Energy, Shorelight, Claros Technologies, Supervizor, Maven AGI, APOLLO, are the Top 10 North American Startups Funding Deals of This Week.