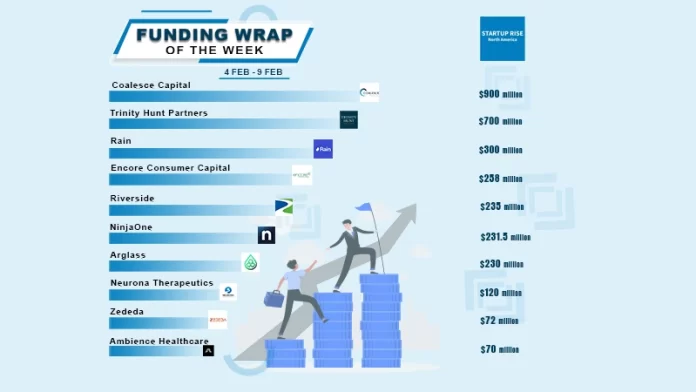

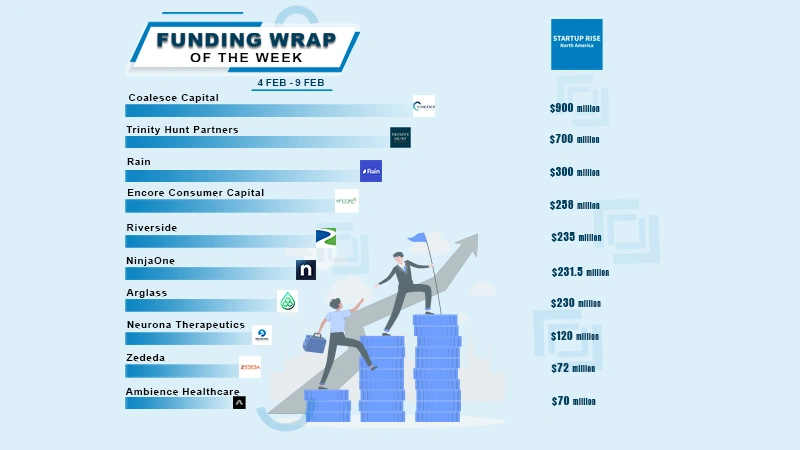

There are a lot of North American Startups Funding Deals for growth-stage and early-stage deals this week; We will discuss about the Top 10 North American Startups Funding Deals

The Top 10 North American Startups Funding Deals of This Week

Table of Contents

Coalesce Capital

NYC-based Coalesce Capital secures $900million inaugural funding. The Fund was oversubscribed and secured investor commitments in nine months, above its original target of $750 million. Coalesce now has approximately $1.0 billion in regulatory assets under management.

Coalesce Capital is a private equity firm that partners with entrepreneurs and management teams to build enduring value around differentiated businesses. Dedicated to investing in human capital-driven and technology-enabled services companies, the firm’s growth-oriented investment philosophy centers around its conviction that people are the most important ingredient of value creation.

Trinity Hunt Partners

TX-based Trinity Hunt Partners secures its fund VII, at $700million funding. Insurance firms, pension funds, endowments, foundations, consultants, funds of funds, and family offices were among its varied group of investors.

With more than $1.7 billion in assets under management, Trinity Hunt Partners is a growth-oriented middle market private equity firm that works with entrepreneurs to create world-class businesses in the consumer services, healthcare, and business sectors.

Rain

CA-based Rain secures $300million in funding. The new credit arrangement was supplied by Clear Haven Capital Management. The company plans to expand its product to more employers who want to implement earned wage access as a benefit, according to the fresh fundraising round.

Employers can provide employees with the opportunity to access their earned pay through Rain. This benefit has already been made available to hundreds of global businesses. Their goal is to restore individual freedom by empowering people to manage their money and income. Predatory financial products, such as overdraft fees and payday loans, are being eliminated.

Encore Consumer Capital

CA-based Encore Consumer Capital secures Encore Consumer Capital Fund IV at $258M of commitments. Encore, founded in 2005, will continue to invest in lower middle market companies with between $10 million and $150 million of annual revenues targeting attractive and underserved segments of the consumer staples industry.

Encore Consumer Capital is a private equity investment firm focused on the consumer products industry. The firm has raised over $900 million in committed capital and invested in over 38 companies in the sector.

Riverside

NYC-based Riverside Secures RAC Riverside Acceleration Capital Opportunity Fund II, L.P., at $235Million. With the closing of this fund, RAC has increased its growth equity investment capacity by more than four times.

The Riverside Company is a global investment firm that aims to drive transformative growth and build lasting value in order to position itself as one of the top private capital choices for employees and business owners in the smaller end of the middle market.

NinjaOne

TX-based NinjaOne secures $231.5million in series C round funding led by ICONIQ Growth. Frank Slootman, Chairman and CEO of Snowflake; and Amit Agarwal, President of Datadog; among others also invested in the round.

NinjaOne automates the hardest parts of IT, empowering more than 17,000 IT teams with visibility, security, and control over all endpoints. The NinjaOne platform is proven to increase productivity, while reducing risk and IT costs.

Arglass

GA-based Arglass raised over $230million in funding. The company plans to use the money to construct a second furnace on its Valdosta, Georgia, campus. To pay for the building, Arglass obtained loans and structured equity. The supporters were kept a secret.

In the US, Arglass are the sole company producing effective and flexible glass containers. Their three guiding principles—flexibility, efficiency, and sustainability—allow them to provide the glass container market with a superior option in a sector that is mostly focused on products that need lengthy production runs.

Neurona Therapeutics

CA-based Neurona Therapeutics secures $120million in funding. This round was co-led by Viking Global Investors and Cormorant Asset Management with participation from new and existing investors.

Neurona is focused on developing regenerative cell therapy candidates with single-dose curative potential. Neurona’s investigational allogeneic, off-the-shelf, cell therapy candidates are designed to provide long-term repair of dysfunctional neural networks for multiple neurological disorders.

Zededa

CA-based Zededa secures $72million in growth funding. Smith Point Capital led the round, which raised the total to $127 million. New investors Hillman Company, LDV Partners, Endeavour Catalyst Fund, and Forward Investments (DEWA) also participated.

By taking cloud computing to the edge, ZEDEDA makes edge computing simple, transparent, and inherently safe. With increased visibility, security, and control, ZEDEDA lowers the cost of managing and orchestrating dispersed edge applications and infrastructure.

Ambience Healthcare

Ca-based Ambience Healthcare secures $70million in series B round funding. Leading the round, which raised the total to $100 million, were Kleiner Perkins and OpenAI Startup Fund, with participation from Memorial Hermann, Andreessen Horowitz, and Optum Ventures, current investors.

The goal of Ambience Healthcare is to use cutting-edge generative AI technology to empower physicians. The Ambience AI operating system comprises a comprehensive set of apps that are intended to mitigate clinician burnout, enhance overall system performance, and facilitate the provision of high-quality healthcare.

Name the Top North American Startups Funding Deals in This Week?

Coalesce Capital, Trinity Hunt Partners, Rain, Encore Consumer Capital, Riverside, NinjaOne, Arglass, Neurona Therapeutics, Zededa and Ambience Healthcare are the Top North American Startups Funding Deals in This Week.